Pocket Option Fees Comprehensive Guide to Understanding Costs

Pocket Option Fees: Comprehensive Guide

If you’re considering trading with Pocket Option, understanding the Pocket Option Fees fees Pocket Option charges is crucial. Whether you are a seasoned trader or a newcomer, knowing how fees impact your trading can enhance your overall experience and profitability. In this article, we will delve into the different types of fees associated with Pocket Option, how they are calculated, and tips for minimizing costs.

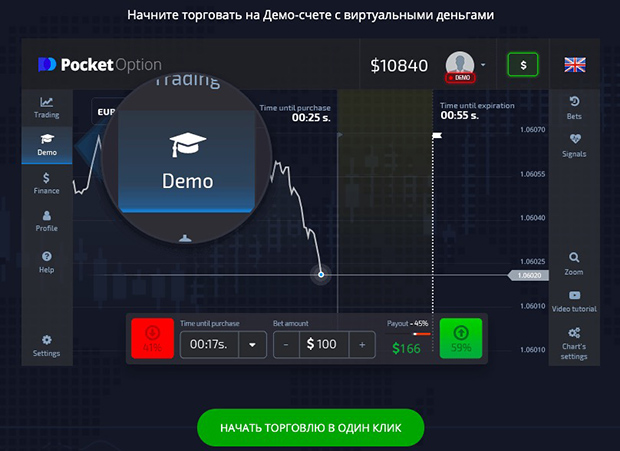

1. Introduction to Pocket Option

Pocket Option is a popular broker known for its intuitive trading platform and user-friendly interface. It allows traders to engage in binary options trading across various digital assets, including forex, stocks, commodities, and cryptocurrencies. As with any trading platform, there are associated costs that traders should be aware of. Understanding these costs can make a significant difference in your trading effectiveness and profitability.

2. Types of Fees

Understanding the different types of fees that Pocket Option charges is vital for effective trading. The principal fees are:

2.1. Trading Fees

Trading fees are typically applied on a per-trade basis. With Pocket Option, these fees may vary depending on the asset you are trading and market conditions. It’s essential to be aware of these costs as they directly affect your potential profits.

2.2. Deposit and Withdrawal Fees

Pocket Option has specific deposit and withdrawal fees that vary by payment method. While many methods support zero fees for deposits, withdrawals may incur charges based on the platform’s policies and the payment method selected. Be sure to check the fees associated with your preferred payment method prior to making transactions.

2.3. Inactivity Fees

Like many trading platforms, Pocket Option may charge inactivity fees if an account remains dormant for an extended period. This fee serves as a reminder to ensure that your account remains active. For traders who plan to take a break from trading, it’s essential to understand these potential charges.

2.4. Spread Costs

The spread refers to the difference between the buying and selling prices of an asset. It is a hidden cost that traders need to factor into their trading strategy. While Pocket Option offers competitive spreads, it’s crucial to monitor these costs, especially for frequent traders.

3. How Fees Impact Trading

The various fees associated with Pocket Option can significantly impact your overall trading performance. For instance, if high trading fees are incurred on a frequent basis, even successful trades may yield minimal profits. It’s essential to calculate your potential earnings while factoring in these fees to get a clear picture of your net profits.

4. Minimizing Fees

To enhance your trading experience and maximize profits, consider the following strategies for minimizing fees on Pocket Option:

4.1. Choose Cost-effective Payment Methods

Select payment methods that do not incur deposit fees to ensure more of your funds go toward trading rather than fees. Research the different payment options available and their respective costs.

4.2. Keep Trades Strategic

Limit the number of trades you execute to avoid excessive trading fees. Focus on quality trades rather than quantity, allowing you to potentially enhance your earnings without incurring high transaction costs.

4.3. Monitor Account Activity

Stay active in your trading account to avoid inactivity fees. Regularly engage in trading activities or maintain minimal balance transactions to keep your account active.

4.4. Compare Asset Spreads

Before trading, compare the spreads of different assets. Selecting assets with lower spreads can reduce your overall costs and improve your risk-to-reward ratio.

5. Conclusion

In conclusion, understanding the fees associated with Pocket Option is vital for any trader looking to maximize their trading effectiveness. By being informed about the types of fees, how they impact trading, and strategies for minimizing these costs, traders can improve their profitability while navigating the financial markets. Always stay aware of the current fee structure and adapt your strategies accordingly to ensure a successful trading experience.